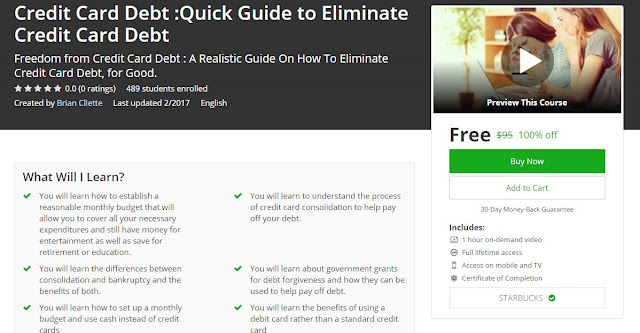

What Will I Learn?

You will learn how to establish a reasonable monthly budget that will allow you to cover all your necessary expenditures and still have money for entertainment as well as save for retirement or education.

You will learn to understand the process of credit card consolidation to help pay off your debt.

You will learn the differences between consolidation and bankruptcy and the benefits of both.

You will learn about government grants for debt forgiveness and how they can be used to help pay off debt.

You will learn how to set up a monthly budget and use cash instead of credit cards

You will learn the benefits of using a debit card rather than a standard credit card

You will learn how to delay instant gratification and save for major expenditures such as big-screen TVs rather than putting them on a credit card and indulging instant gratification.

You will learn how to find a bank with the best interest rates and benefits for the one credit card you keep for emergencies.

Requirements

- A basic understanding of how Credit Cards work

Description

Starting in the 1980s credit cards became the preferred payment method of most American shopper ís credit card to give shoppers a sense of power, entitlement, and instant gratification as well as the feeling that they won't need to worry about their bills.

At least not until the end of the month. This living like there ís no tomorrow. This Way of thinking made sense when credit cards first came on the market as a mainstream payment method because the world was engaged in the Cold War and everyone felt as though the world was going to end tomorrow so they should live in the moment and have everything they desired and not worry about spending and debt because there would be no one there to collect, unfortunately, that way of thinking did not work because the Cold War never went hot and there was a tomorrow and credit card companies wanted their money and many people got further and further into debt trying to pay off their credit card bill.

So much so that they started using one credit card to pay off another which only served to increase their debt and thanks to the magic of technology and shopping over the Internet and the ease with which someone can apply for and acquire a credit card credit card to have become more ubiquitous than ever. Most people these days. Under the age of 35.

Dont even carry cash on a regular basis and everything they need on a monthly or daily basis is paid for with the use of a credit card (most likely several credit cards) which only serves to feed the cycle of debt.

If however you are sincere about getting out from under credit card debt and saving money for necessary expenditures like college for yourself or your kids, and retirement, then this is the cross for you. This course will teach you not only how to get out from under the burdens of credit card debts once and for all, but also how to set up and stick to a monthly budget for all of your necessary (and sometimes unnecessary expenditures) so that you can live a debt-free and happy life.

If however you are sincere about getting out from under credit card debt and saving money for necessary expenditures like college for yourself or your kids, and retirement, then this is the cross for you. This course will teach you not only how to get out from under the burdens of credit card debts once and for all, but also how to set up and stick to a monthly budget for all of your necessary (and sometimes unnecessary expenditures) so that you can live a debt-free and happy life.

What you will learn:

1) You will learn how to establish a reasonable monthly budget that will allow you to cover all your necessary expenditures and still have money for entertainment as well as save for retirement or education.

2) You will learn to understand the process of credit card consolidation to help pay off your debt.

3) You will learn the differences between consolidation and bankruptcy and the benefits of both.

4) You will learn about government grants for debt forgiveness and how they can be used to help pay off debt.

5) You will learn how to set up a monthly budget and use cash instead of credit cards

6) You will learn the benefits of using a debit card rather than a standard credit card

7) You will learn how to delay instant gratification and save for major expenditures such as big-screen TVs rather than putting them on a credit card and indulging instant gratification.

8) You will learn how to find a bank with the best interest rates and benefits for the one credit card you keep for emergencies.

1) You will learn how to establish a reasonable monthly budget that will allow you to cover all your necessary expenditures and still have money for entertainment as well as save for retirement or education.

2) You will learn to understand the process of credit card consolidation to help pay off your debt.

3) You will learn the differences between consolidation and bankruptcy and the benefits of both.

4) You will learn about government grants for debt forgiveness and how they can be used to help pay off debt.

5) You will learn how to set up a monthly budget and use cash instead of credit cards

6) You will learn the benefits of using a debit card rather than a standard credit card

7) You will learn how to delay instant gratification and save for major expenditures such as big-screen TVs rather than putting them on a credit card and indulging instant gratification.

8) You will learn how to find a bank with the best interest rates and benefits for the one credit card you keep for emergencies.

Who is the target audience?

- The ideal candidate would have a desire to change their current financial situation, learn how to eliminate Credit Card Debt

- This class is not meant for anyone looking for a quick fix to their credit woes

- Anyone with a Credit Card and a Large Sum of Credit Card Debt

About Mustapha

I am online instructor at Udemy. My passions are: Mobile and Web Development, Entrepreneurship and Management. You can read my full biography on My Udemy Page. Feel free to follow me social media to know more about me and the topics and courses I'm teaching.